Export tariffs for selling to the USA in nearshoring context

9/07/2024As a member of the United States-Mexico-Canada Agreement (USMCA), Mexico benefits from exempted export tariffs when selling products to the United States.

Nearshoring to Mexico has reinforced this dynamic, making the Latin American country the primary trading partner of the United States.

Generally, commercial tariffs in the United States are determined based on the value of goods entering the country from other regions.

Products exempt from tariffs under the USMCA

The following list includes items whose sale to the United States is not subject to tariffs if they meet the conditions established in the trade agreement.

| Category | Description | Tariff status under the USMCA |

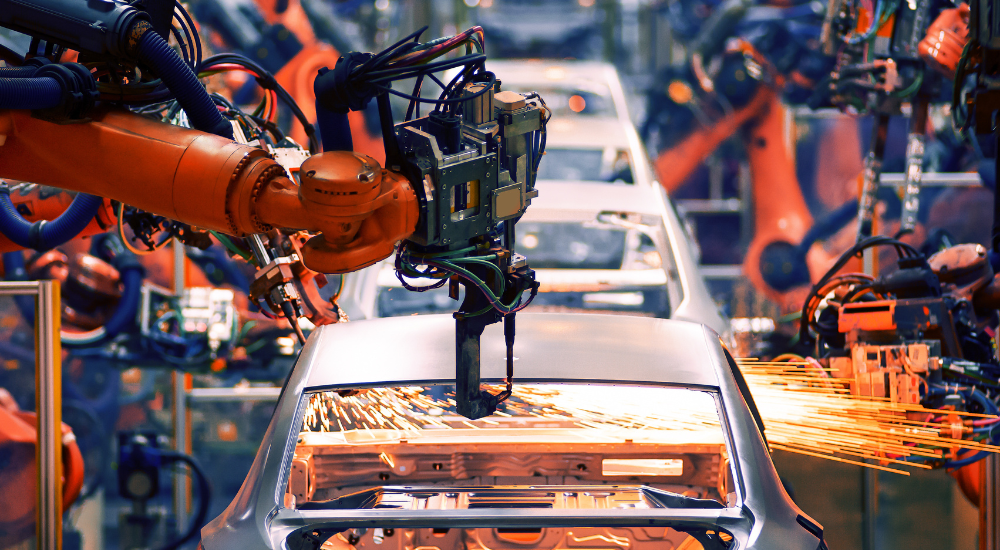

| Automobiles | Passenger vehicles and light trucks |

Eliminated, if the rules of origin are met |

| Auto parts and accessories | Engines, brakes, etc. | Eliminated, if the rules of origin are met |

| Household appliances | Refrigerators, washing machines, etc. | Eliminated, if the rules of origin are met |

| Pharmaceutical products | Medicines and medical products |

Eliminated, if the rules of origin are met |

| Fruits and vegetables | Apples, tomatoes, etc. |

Eliminated, if the rules of origin are met |

| Clothing and textiles | Shirts, T-shirts, pants, fabrics, etc. | Eliminated, if the rules of origin are met |

| Technology and electronics | Computers, cell phones, etc. | Eliminated, if the rules of origin are met |

| Chemical products | Plastics, industrial chemicals |

Eliminated, if the rules of origin are met |

| Metals and minerals | Steel, aluminum, copper, etc. | Eliminated, if the rules of origin are |

Source: United States-Mexico-Canada Agreement (USMCA)

According to the USMCA text, for products to qualify for tariff elimination or exemption, they must meet certain content requirements that specify what percentage of the value must be of origin from the signatory countries.

Some products, particularly in the agricultural sector, may be subject to quotas or exceptions.

What method does the United States use for tariff calculations?

The United States uses the Harmonized Tariff Schedule (HTS) to determine import tariffs.

In this system, tariffs are calculated on an “ad valorem” basis, depending on the cost of the product. This value is increased by:

- Insurance

- Freight (referred to as CIF, for "Cost, Insurance, and Freight", as it provides a reference of the total cost associated with the import).

“In 2023, Mexico ended China’s 16-year dominance as the top exporter to the United States. The Latin American country reclaimed this position with an export value of $418.3 billion, according to data from the National Institute of Statistics and Geography (INEGI).”

HTS codes are more detailed than HS codes (Harmonized System) and standardized internationally for classifying goods. HTS codes consist of:

- Basic 6 digits: Corresponding to the HS system for international product categorization.

- Additional digits: Between 7 and 10 total digits provide specific details.

Codes are assigned based on the nature, type, and function of each product. They are used to:

- Determine Tariffs and Taxes (digits 7 and 8 of the product code): Establish the costs that importers and exporters must pay.

- Statistical Purposes (digits 9 and 10 of the product code): Facilitate the collection and analysis of trade data.

The differentiation of HTS codes is crucial due to the large volume of goods traded globally and the variations in product names between countries.

How are export tariffs to the United States calculated?

To calculate the tariffs when selling products to the United States, it is essential to know the HTS code for each good.

The assigned tariff rate is multiplied by the total value of the items to determine the amount payable.

Generally, the United States applies a tariff of 3.5% on the total value of imported goods, although this rate may be lower depending on the product type. Below is a list of products with information on the rates used for calculation.

| Category | Description | General tariff rate |

| Automobiles | Passenger vehicles with engines under 2,000 cc | 2.5% |

| Auto parts and accessories | Engines, brakes, etc. | 2.5% - 25% depending on the type |

| Household appliances | Refrigerators, washing machines, etc. | 1.5% - 5% depending on the product |

| Pharmaceutical products | Medicines and medical products | 0% |

| Fruits and vegetables | Apples, tomatoes, etc. | 0% - 15% depending on the type |

| Clothing and textiles | Shirts, T-shirts, pants, fabrics, etc. | 0% - 32% depending on the type |

| Technology and electronics | Computers, cell phones, etc. | 0% - 2.6% depending on the type |

| Chemical products | Plastics, industrial chemicals | 0% - 6% depending on the type |

| Metals and minerals | Steel, aluminum, copper, etc. | 0% - 10% depending on the type |

Source: United States international trade Comission

The increase in activities resulting from nearshoring to Mexico has not changed the rules for commercial tariffs when exporting to the United States.

However, foreign companies that move their production to Mexico can gain significant advantages, such as reduced or eliminated tariffs.

In this context of relocating activities, Frontier Industrial offers industrial land for sale and industrial buildings for rent to companies looking to relocate their operations or start new activities in Mexico.

Contact us to check availability and discover how we can help you develop your project in the main industrial areas of the country.

.png)